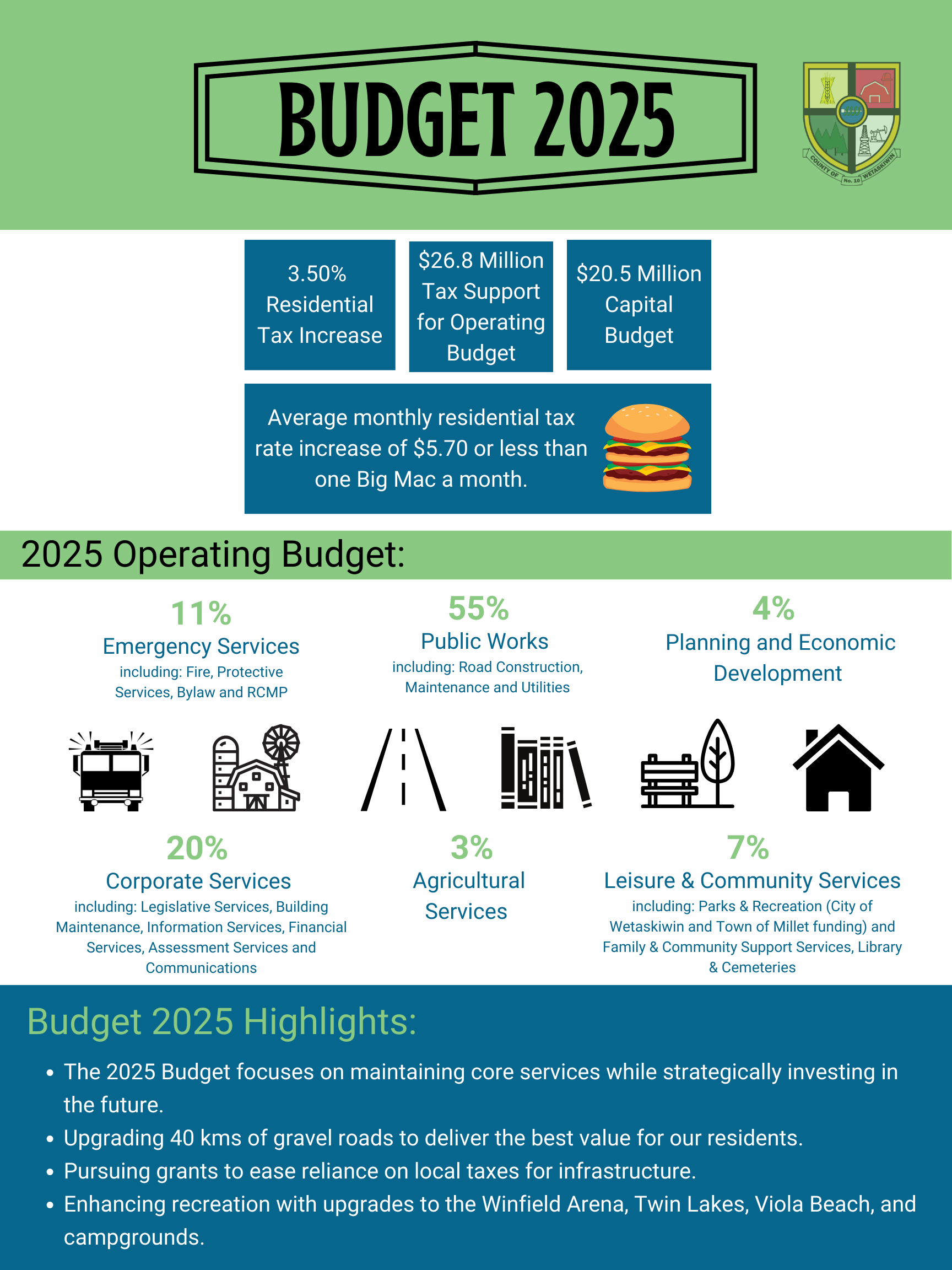

On April 22, 2025, the Council of the County of Wetaskiwin No. 10 approved the 2025 tax rate, supporting a balanced budget that prioritizes core services, infrastructure, and community well-being. The County’s total operating and capital budget for 2025 is $70 million, with $26.8 million of tax support going towards municipal operations.

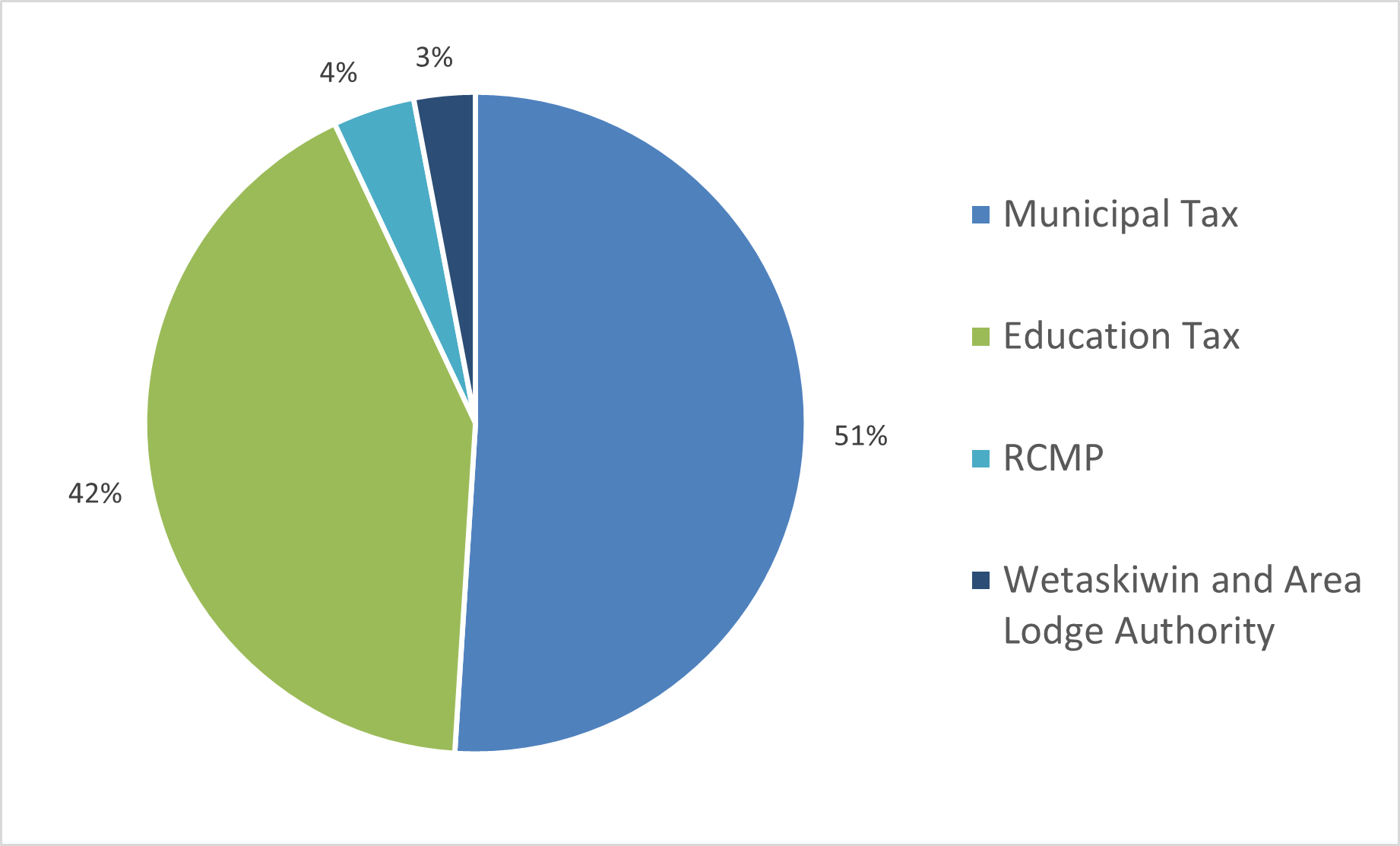

This year, the average residential taxpayer will see an 8.95% increase in property taxes. Of that increase, 3.5% is due to municipal operations and 5.45% is due to an increase in the Provincial Government’s Education Tax Requisition. This portion of your taxes is set by the Province, not the County of Wetaskiwin and accounts for approximately 42% of your total property tax bill, which is transferred directly to the Province for education funding. The County is required to collect it on the Province’s behalf and has no authority to change or reduce it. If you have questions or concerns about this Provincial Education Tax increase, please reach out to your local MLA.

“Each year, we strive to ensure that tax dollars are used responsibly to maintain core services and invest in priorities that matter to our residents,” said Reeve Josh Bishop. “While education taxes are set by the Government of Alberta and beyond our control, we’re committed to being transparent about where your tax dollars go. This includes the 42% allocated to the Province for education and another 4% for RCMP policing costs. County Council continues to support small, incremental tax increases while investing in core services and working to reduce our reliance on residential taxes over the long term.”

Your annual property tax notice includes more than just municipal taxes. It also covers:

- The provincial education tax,

- RCMP policing costs,

- A contribution to the Wetaskiwin and Area Lodge Authority, which supports affordable housing for seniors in our region.

In accordance with Section 311 of the Municipal Government Act, please be informed that the Assessment Notices for the County will be mailed by May 9, 2025. Following this notification, all assessed individuals are considered to have received their Assessment Notices. Ratepayers who wish to discuss their assessments in more detail are encouraged to contact the Assessment Department at (780) 361-6237.

Please notify the County of Wetaskiwin No. 10 if you have not received your notice within a reasonable time frame.

Tax payments for the year are due by August 31, 2025. For detailed information on payment methods and instructions, please visit the County of Wetaskiwin's official website.

For further information on the County’s budget, please contact Eric Hofbauer, Director of Finance, at (780) 361-6228 or via email.